By Lorena Lara, Administration Office Manager.

Firstly, I thought my little space in this blog would not be very interesting for the vast majority of its audience but, after thinking a little about it, I concluded there is nothing further from the truth.

Although many people are unwilling to notice, in any kind of job, every professional worker or company who develops an active working activity has to maintain a tight relationship with the Admin dept. That is where I will try to provide you with some basics, ideas, tricks and advises to help you making this part of the job more enjoyable, or at least easier to understand, even if this is an area that most people dislike.

Once I understood how I might contribute to this blog, a huge quantity of subjects to talk about suddenly came to my mind: invoicing, taxes, external or internal management issues, digital certifications, online paperwork and, of course, everything you can have doubts about.

That is why my aim is taking advantage of my first post to talk about the issuing of invoices, which is, from my point of view, the most basic subject in Administration.

Many of you have centralized all the admin issues with an external manager; however, most of you make your own invoices and generally in a correct way. Nevertheless, along my professional experience years, I found sometimes great professionals in the industry who did not have a clue about how to make a correct invoice for their rendered services.

Let’s divide these explanations in several sections. Firstly, I will talk about the mandatory fields an invoice must include. Secondly, I will comment a little about the design. Lastly, I will give some absolutely personal indications according to my expertise.

1. Mandatory Fields.

Every invoice, to be legally considered as such, must clearly include these mandatory information fields:

1. Invoice Issuer Data: Full Name, Billing Address (registered at the corresponding Tax Office) and, in Spain, the NIF or CIF, this is, a Tax ID Number given by the Government. Also, you can complete these data with the telephone number or the email address, even if these are not mandatory themselves.

2. Customer Data or invoice recipient: Full Name, Billing Address and, in Spain, the NIF or CIF.

3. Invoice Number

4. Invoice Issue Date

5. Invoice Description: This is the description of the products and services you rendered for the invoice’s recipient. In this case, the description of the service is usually described by the provider, although there are times, especially in the translation industry, in which the customers specifies several fields which are mandatory to be in the description (as the purchase order number, word counts, etc.)

6. Tax Base: This is the raw amount, this is, before the taxes are applied; the amount to be charged for the rendered services.

7. Applicable Taxes: In Spain, we can basically find two types of taxes:.

V.A.T. (Value Added Tax): We all know this tax. Nowadays, though we do not know until when, the percentage of this tax is a 21 % on the tax base amount. Thus, in your invoice you must include, separately, the applied percentage and the amount it is equal to.

I.R.P.F. (Personal Income Tax): Including it in the invoice is not mandatory. However, this is a retention the Customer must pay in the professional’s behalf to the National Tax Office so, in order to avoid any mistake, we strongly recommend to include it in any invoice. Currently, this tax is also a percentage of 21 %, except for the recent professionals who, for a limited time period, may reduce this tax to a 9 % percentage.

8. Invoice Total: This quantity will be the NET amount of the invoice, this is, the cash the professional will receive. This will be the result after adding the tax base, plus the VAT and minus the I.R.P.F.

Invoice Total = TB + VAT – I.R.P.F.

2. Invoice Design

Obviously, the invoice design is completely free, there are no specific guidelines to be followed. They can be made in Excel, in Word or in any other software that may be convenient.

You can easily make a basic invoice template. It is enough to know lightly any of these applications. Anyway, if you have a more advanced knowledge of these, you can insert some personal logotype or make a well-prepared invoice. Furthermore, you will easily find thousands of free templates on the web.

Now, I would like to emphasize on one thing. Although an invoice may seem a banal issue, from my point of view, an invoice is one more way to sell ourselves to our customers. And, though this may seem a nonsense, the invoice is the only mean that the person handling your invoice (in this case, me) will have to meet you. So, think about it: your customer could get an impression, maybe wrong, from you and your work.

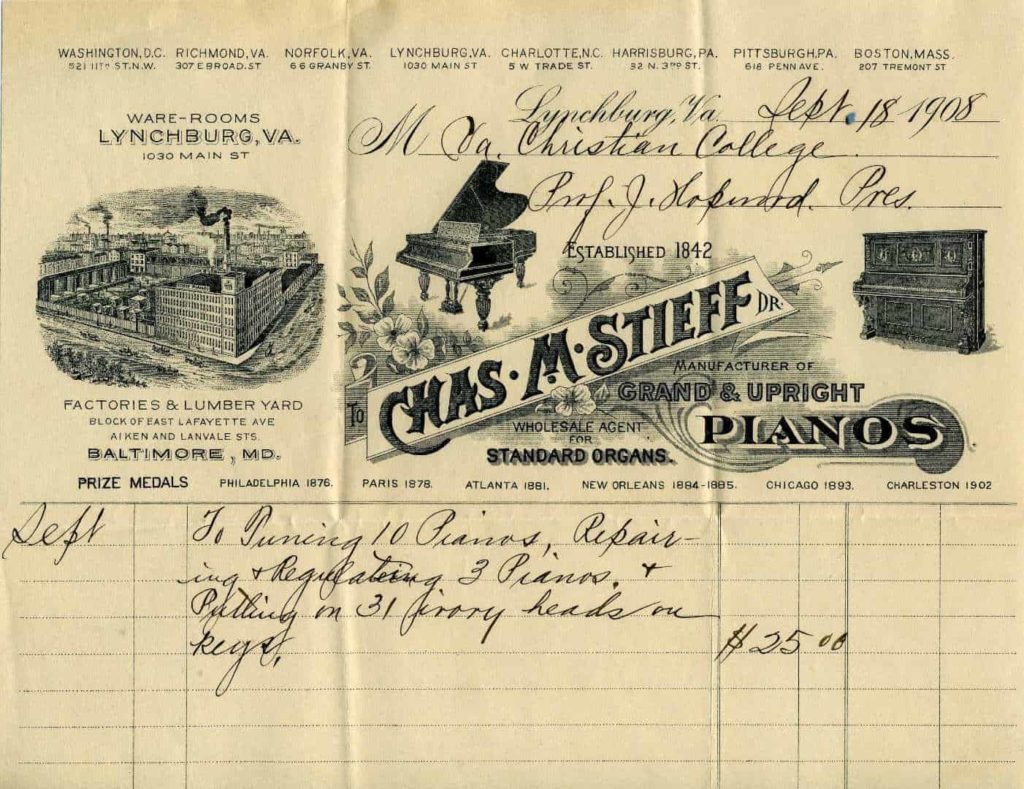

Let’s see an example, would you think the same thing about these two professionals if the only thing you have got from them is their invoices? Who would you firstly entrust a job to?

From the legal point of view, both invoices are correct. They both include the mandatory fields, but the impression you receive from every one of them is completely different, I think. Maybe this is my obsession with work.

Believe me when I say that in this world it is very important to sell oneself well in every aspect, although this subject could be useful for another post.

3. Recommendations

Lastly, I am sharing with you some (absolutely subjective) recommendations in order to make correct invoices.

1. I think it is quite important that invoices sent by mail are in PDF format and, if protected, much better. Try not to send an Excel or Word file, as they can be easily edited.

2. Send your invoices with a format that allows a one-page printing, if possible. I sometimes receive invoices sent in Word or Excel format and, when I print them, they take up two sheets; they also show misplaced elements, which is quite annoying. So, all these issues can be easily solved by sending your invoices in PDF format, because in this way, you have been able to check the final printing results.

3. For the person receiving the invoice, it is much better if this is in upright position. This is just a matter of internal management. When passing the information to the system, it is less time-consuming if all the invoices are in the same position. Furthermore, the file and/or search of the invoices would be easier too.

4. Name the invoice in an organized and easily identifiable way. For example, YourName_Number_Date.

5. In the Description area (and this is one of the requirements that I mentioned above, in this case, required by Nóvalo) you must clearly state the Purchase Order the rendered service refers to.

6. Even if not mandatory fields, you can add to your invoice some other data, as the receipt date, the bank data, your Paypal account, etc.

7. If you make any amendment to these data, inform when sending the invoice, as this information is not reviewed in every sending.

8. As people usually use their previous invoices as templates for the new ones, please be sure to change any dynamic data (like the invoice number, the tax base, date, taxes and the total). And, finally, be sure not to break any formula when erasing information.

Of course, all these are simple recommendations and guidelines, most of all, from the administration’s point of view. Providing that your invoices include the mandatory information, you can make them and send them in the most comfortable way for you or the way you may prefer.

Thank you so much for reading my post until this point, as this is a new experience for me and I was looking forward sharing it with all you. Furthermore, I hope having provided you with a little help in this admin task you all have to pass through.

See you in my next post!